Gross Salary Calculator Usa

Salary Calculator Results Average Annual Salary. The Salary Calculator for US Salary Tax Calculator 202122 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2021 and 2020 with detailed updates and supporting tax tables.

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Total annual income Adjustments Adjusted gross income Step 2.

Gross salary calculator usa. Next select the Filing Status drop down menu and choose which option applies to you. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. Social Security and Medicare.

The latest tax information from 2021 is used to show you exactly what you need to know. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Hourly rates and weekly pay are also catered for.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The results are broken up into three sections. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Your gross salary - Its the salary you have before tax.

The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States. Use the calculator to work out an approximate gross wage from what your employee wants to take home. In order to calculate the salary after tax we need to know a few things.

Tax liability Credits Withheld What you owe IRS. See how we can help improve your knowledge of Math Physics Tax Engineering and more. To enter your time card times for a payroll related calculation use this time card calculator.

If you make 55000 a year living in the region of New York USA you will be taxed 12213. Can be used by salary earners self-employed or independent contractors. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

The Simple tax calculator is also useful for comparing salaries in Mexico great if you are looking at a new job in Mexico or comparing salaries in different industries in Mexico. That means that your net pay will be 42787 per year or 3566 per month. Why not find your dream salary.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The PaycheckCity salary calculator will do the calculating for you. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if.

Subtract any deductions and payroll taxes from the gross pay to get net pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The Salary Calculator tells you monthly take-home or annual earnings considering Federal Income Tax Social Security and State Tax.

Your average tax rate is 222 and your marginal tax rate is 361. The Advanced Tax Calculator is designed for those who wish to calculate their tax commitments with more detail for example you may with you calculate your monthlyquarterlyannual tax withholdings to ensure you retain sufficient. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

This marginal tax rate means that your immediate additional income will be taxed at this rate. 1000000 Based upon the information that you provided our calculator estimates an average annual salary of 45000. Taxable income Tax rate Tax liability Step 4.

Dont want to calculate this by hand. This number is the gross pay per pay period. 2163 hour No.

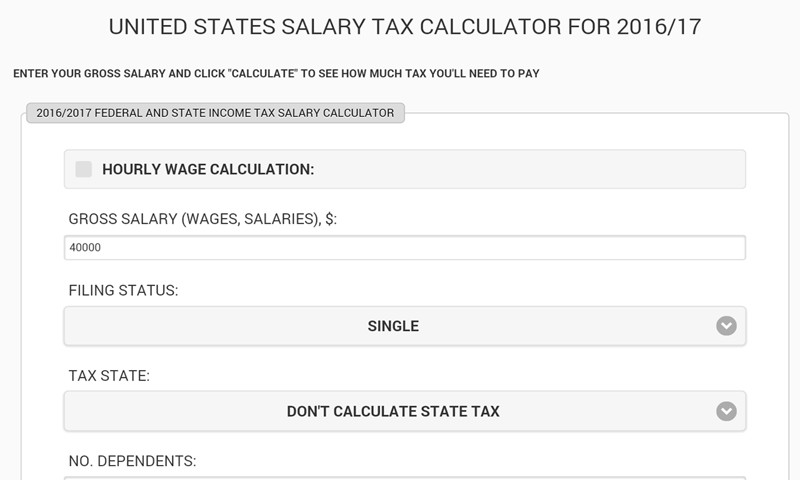

One of a suite of free online calculators provided by the team at iCalculator. Using the United States Tax Calculator First enter your Gross Salary amount where shown. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. Below are your federal salary paycheck results. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary.

45000 Average Hourly Salary. A complete list of municipal taxes including County. By default the US Salary Calculator uses the latest tax information as published by the IRS and individual State Governments though you can choose previous tax years is required 202122 is.

Your results have expired. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Gross Pay or Salary.

If you are filing taxes and are. Next select the State drop down menu and choose whichever state you live in. Adjusted gross income Post-tax deductions Exemptions Taxable income Step 3.

Where you live - The municipal tax differs between the municipalities.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Net Salary Calculator Canada Salary Calculator Bad Credit Mortgage Online Mortgage

Paycheck Calculator Take Home Pay Calculator

Failure To Pay File Penalty Calculator Https Www Irstaxapp Com Failure To Pay File Penalty Calculator Failure Calculator Tax Deductions

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

Exponential Moving Average Calculator Good Calculators Moving Average Exponential Moving

How To Calculate Wages With Your Check Stub Payroll Template Statement Template Payroll Checks

Need A Wage Calculator Advertising Booking Form 2015 Here S A Free Template Create Ready To Use Forms At Formsbank C Advertising Booking Spreadsheet Template

Top 7 Free Payroll Calculators Timecamp

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Appstore For Android

United States Salary Tax Calculator For Android Free Download

Top 7 Free Payroll Calculators Timecamp

Post a Comment for "Gross Salary Calculator Usa"