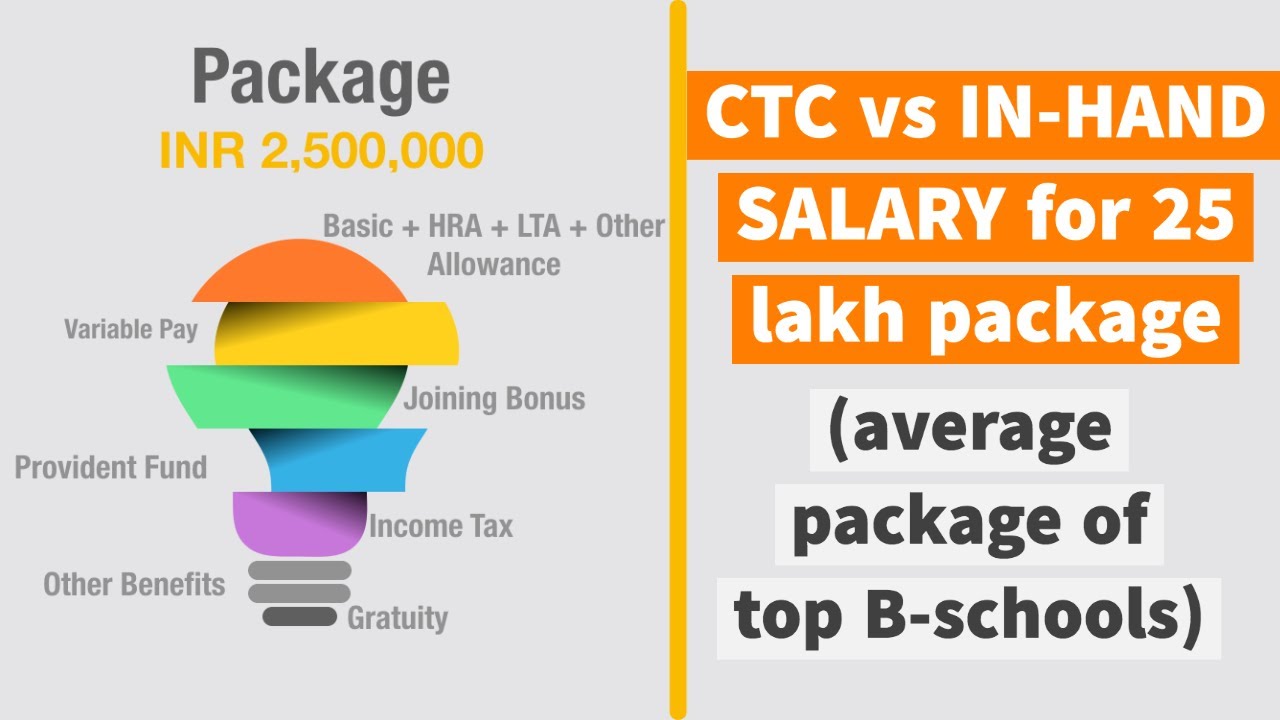

Take Home Salary For 25 Lakhs

Take home salary Gross Salary. In this new video we break down an average salary 25 LPA of a Tier 1 MBA school in India.

Income Tax Filing Year 4 Top Risks Of Income Tax Filing Year Income Tax Return Filing Taxes Income Tax

While others were just offered 9 lacs pa.

Take home salary for 25 lakhs. For example your Cost To Company CTC is Rs 8 lakh. Subtract the Income Tax Provident Fund PF and Professional Tax from the Gross Salarydetermined in step 1. Take home salary -Gross Salary - 1178400.

You are currently posting as works at. Total Amount Principal Interest 790. Take-Home Salary is the total salary that an employee gets after all necessary deductions are made.

New tax rules allow for greater tax saving for income above 15 lakhs in this case as illustrated below. The interest paid on home loan is allowed as deduction from your income up to Rs. However during my next job I made sure to inquire about the take home salary.

Home Loan EMI Details for 25 Lakh loan amount. Your total gross salary is Rs 800000 Rs 50000 Rs 750000. 2 lakh per year for your own house.

To calculate the take-home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC. Hey GuysIn this new video we break down an average salary 25 LPA of a Tier 1 MBA school in India. Quarterly variable be will around 100 as it depends upon the unit or company performance depending upon your designation.

This will help you understand a typical salary structu. To achieve this you have to let go of tax benefits elucidated under Chapter VI A of the Income Tax rules as well as the standard deduction of Rs 50 000 for FY 2019-20. Amit lives in Bangalore and the rent paid per month is INR 30000.

Taxpayers with income between Rs 50 lakh and Rs 1 crore continue to pay 10 surcharge between Rs 1 crore and Rs 2 crore pay 15 between Rs 2 crore and Rs 5 crore pay 25 and those with income over Rs 5 crore pay 37. 4 on total of income tax surcharge. Take Home Salary Gross Salary - Income Tax - Employees PF ContributionPF - Prof.

Less - Profession tax - 2500. If You want to Know you are eligible for 25 Lakh of Loan amount or Not Use 25 Lakh Home Loan Amount Yearly Calculation for 20 Years Tenure Loan Amount Rs. This is the important part to understand as it will have a 125 contribution from your side and 125.

Minimum Monthly Take home salary - 84945-The takehome salary will increase if the tax liability decreases. This basically depends on the companys salary structure lets go on this by the structure which most of the companies follow. What will be the take home if I have CTC of 925 lakhs CTC in TCS.

Home Loan EMI Details for 30 Lakh loan amount. You can can save a decent amount of tax if you are claiming this benefit. Less - PF Contribution - 21600.

What will be the in hand take home salary for 24 lakhs CTC offered by TCS wherein 1 lakh is retention incentive. 10 of income tax where total income is between Rs. Finally using the above value we can compute the in hand salary as follows.

Please note that our salary calculator is calculating this for FY 2021-22 Current Financial Year. To summarise It would be around 6570K. The employer gives you a bonus of Rs 50000 for the financial year.

But eventually when they calculated the take home salary there was a marginal difference in both of them. CTC Vs Actual Take-home salary I Reality of 25 Lakh Package in India 450. This will help you understand a typical salary structure its various components with a complete break-up.

Amit receives a Basic Salary of INR 120000 per month. Less - Income tax TDS - 134960. Understand from below how do we exactly calculate the In-hand or Take home salary.

Can you take benefit of both HRA exemption and house loan interest. Surcharges on tax remain untouched. Minimum Take home salary - 1019340.

Take-home pay known as in-hand salary in India is the net salary after deducting income tax TDS tax deducted at source in India and other deductions from the gross monthly pay. House Rent Allowance is INR 50000 per month and Special Allowance of INR 30000 per month. Step 1 Download our Excel Calculator Tool and enter your CTC breakup as per the offer letter in the Input Sheet.

For previous years the values would change. The answer is yes if you stay in a rental property and not in your own house property. Calculate Take Home Salary.

The calculator is updated for the Financial Year 2020-21. Take Home Salary Calculator India Excel Tool How to Use Just follow the simple steps below to calculate your take home salary from CTC using this excel calculator. The calculator can help you find your monthly net salary if you know your salary package.

Below is what Amits taxable salary would look like. 50 lakhs and Rs1 crore. 15 of income tax where total income exceeds Rs1 crore.

During my campus placement days I had few of my friends who were offered a CTC of 12 lacs pa. 112500 30 of Taxable income - 1000000 Surcharge.

Www Dharmamgroup Com Career Advancement Skill Training Innovation Technology

Wearehiring For Details Contact 8978957400 Whatsapp Resume 9398998169 Register In Hyse Portal We Are Hiring Find A Job Area Manager

Latest Grey Structure Cost 2019 For House Construction Cost In Lahore Pakistan Construction Cost Home Construction Construction

Learn Digital Academy Takes This Wondrous Opportunity To Congratulate Ujjwal For Getting Placed With Briga Marketing Courses Digital Marketing Growth Marketing

Reality Vs Expectation Income Tax Return Filing Taxes File Income Tax

Bcom Vs Bba Top Colleges Student Choice Colleges And Universities

If The Ctc Package Is 28 Lpa What Will Be Take Home Salary Per Month After Tax Deduction Quora

Budget 2018 Income Tax Slabs For Fy 2018 19 Income Tax Income Income Tax Statement

Top View Modern Contemporary House Plans Kerala House Design Duplex House Design

Ctc Vs Actual Take Home Salary I Reality Of 25 Lakh Package In India Youtube

Pin On Job Interview Tips For Fresher

The Times Group Tax Saving Investment Finance Investing

Akshay Tritiya Special Offer From The Kothari Wheels Rs 1 Down Payment For Any Favourite Maruti Car Down Payment Offer Special Offer

Latest Tds Rate Chart Fy 2019 20 Ay 2020 21 Basunivesh Tax Deducted At Source Accounting And Finance Income Tax

Membership Card Personal Loans Membership Card Personal Loans Online

Anand K Vajapeyam On Twitter Indiaundermodi2 Ease Of Living Will New Wage Code Hit Your Take Home Pay Https T Co 08llf4dnqr Via Toi In 2021 Coding Paying News

Here S A Financial Guide For Couples In Mid Thirties With Income Of Rs 2 5 Lakh Per Month Businesstoday

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Post a Comment for "Take Home Salary For 25 Lakhs"