Adjusted Gross Income Tax Rate Calculator

Tips for Calculating Adjusted Gross Income. How to calculate Adjusted Gross Income AGI.

Income Tax Formula Excel University

How is income tax calculated in 2021.

Adjusted gross income tax rate calculator. Use this calculator to compute your Virginia tax amount based on your taxable income. Some forms allow you to take more adjustments to income than others. As per today there are specific cases in which the tax calculations are based on a modified adjusted gross income as defined within the law.

Take your net income for the year which is your total taxable income including employment income self-employed income net of trade losses rental and investment income and other taxable benefits etc less any pension contributions that are paid gross. The AGI calculation depends on the tax return form you use. How Income Taxes Are Calculated.

But its the most important single number on your tax return. If you dont understand what it is you may end up paying more taxes than you need to. For the tax year 2020 check the line 8b on form 1040-SR.

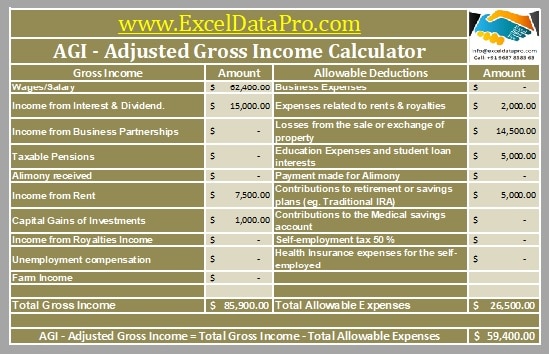

Download the Tax Rate Table here. When you file a tax return you will always see a line to figure out your adjusted gross income or AGI before arriving at your taxable income number. Adjusted gross income AGI or your income minus deductions is important when calculating your total tax liability.

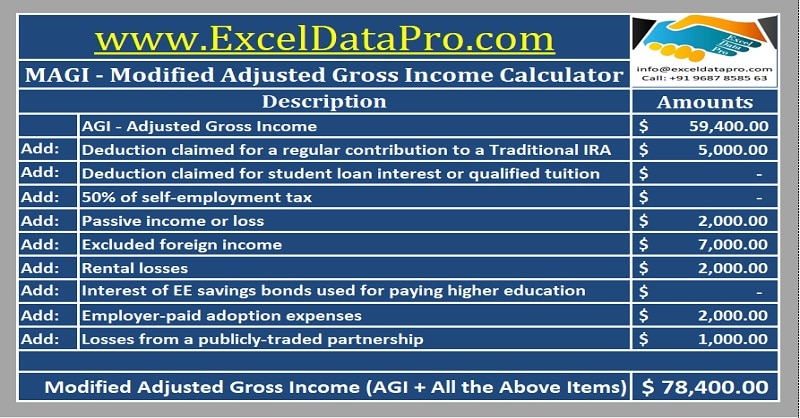

Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. A persons adjusted net income for a tax year is determined as follows. MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs and whether you can make tax-deductible contributions to an individual retirement account or contribute to a Roth IRAEssentially your MAGI is a modification of your AGI.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. Explore many more calculators on tax finance math fitness health and more.

This calculator computes your gross income and subtracts permitted adjustments to arrive at your AGI. To calculate your Virginia tax amount enter your Virginia taxable income and click the Calculate button below. Check your eligibility for a variety of tax credits.

Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. Depending on your tax situation your AGI. How Income Taxes Are Calculated.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. If you want to calculate your adjusted gross income then. Federal individual income tax returns.

You can determine the value of your adjusted gross income from different lines on various forms. Calculate your expected refund or amount of owed tax. For the tax year 2020 check the line 8b on the form 1040.

256 rader Also we separately calculate the federal income taxes you will owe in the. Effective tax rates dont factor in any deductions so if you wanted get closer to what percentage of your salary goes to Uncle Sam try using your adjusted gross income. According to the law the gross income should be officially reported by Form 1040 series US.

Updated February 2020 The phrase adjusted gross income sounds pretty dull. Lets go over what it is and how to calculate your adjusted gross income. Income tax is calculated progressively using income tax bands and personal relief rate came into effect on 1st January 2021.

Persons living with disabilities with a valid exemption certificate are exempted from income tax on their taxable income of KSh 150000 per month and up to KSh 1800000 per year. Using income tax calculator simply add all forms of income together and subtract any tax deductions from that amount. The AGI calculation is relatively straightforward.

If your Virginia adjusted gross income is below the filing threshold your tax is zero. Were proud to provide one of the most comprehensive free online tax calculators to our users. This is your income from all sources including wage income salary taxable interest and dividends alimony business income IRA or pension distributions annuity distributions rental income unemployment compensation royalties the taxable portion of Social Security benefits and other income.

You can use this tax calculator to. It can also be used to estimate income tax for the coming year for 1040-ES filing planning ahead or comparison. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI which helps you determine your taxable income and tax bracket.

First youll need to calculate your total income. Assuming the single filer with 80000 in taxable income opted for the standard deduction 12400 the amount of his AGI that went to the IRS was 149 a far cry from 22. It not only determines your tax bracket.

This form has various versions. Estimate your federal and state income taxes. How to Calculate Adjusted Gross Income.

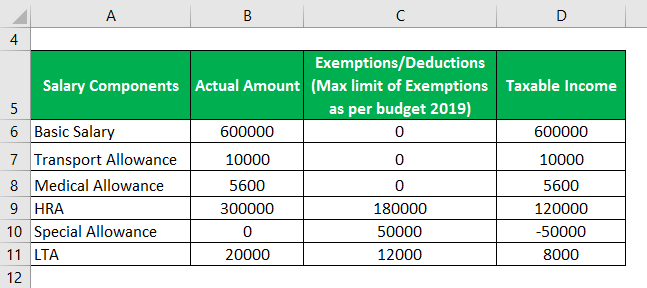

Taxable Income Formula Examples How To Calculate Taxable Income

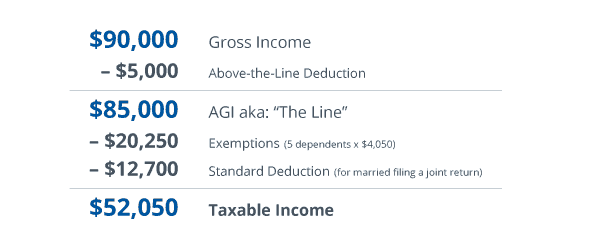

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount

Excel Formula Income Tax Bracket Calculation Exceljet

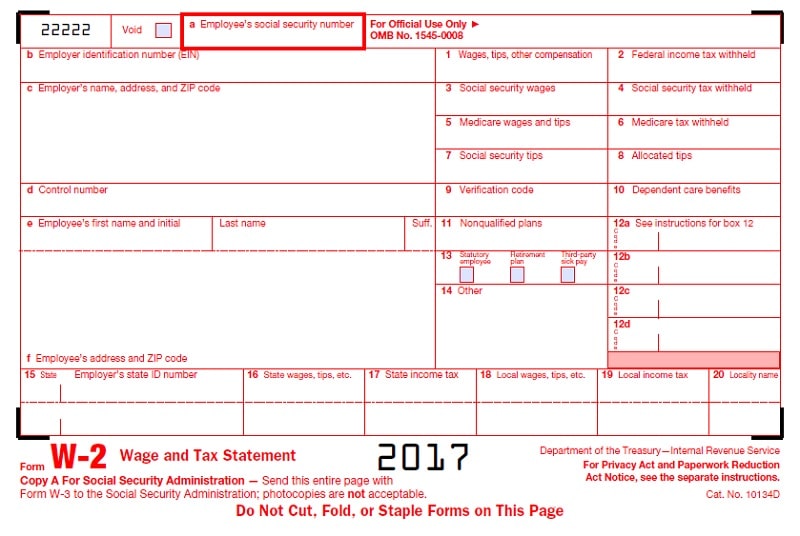

Calculate Adjusted Gross Income Agi Using W2 Tax Return Excel124

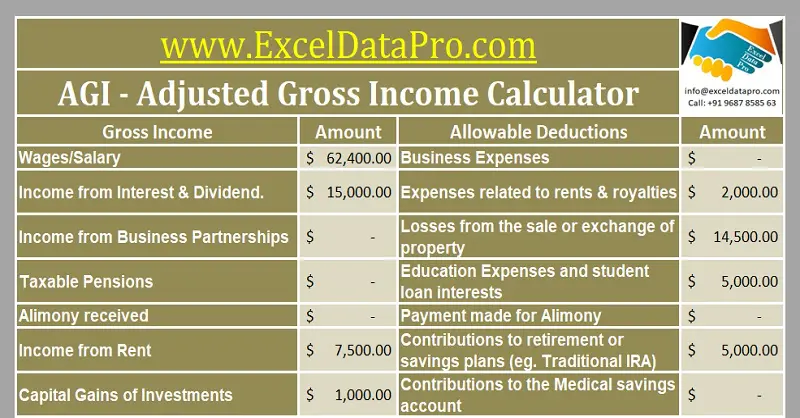

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

What Is Adjusted Gross Income Agi Gusto

Adjusted Gross Income What Is Adjusted Gross Income Agi

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

Standard Deduction Tax Exemption And Deduction Taxact Blog

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Tax Calculator Estimate Your Income Tax For 2020 And 2021 Free

Taxable Income Formula Calculator Examples With Excel Template

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Gross Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

What Is Adjusted Gross Income Agi Gusto

Taxable Income Formula Calculator Examples With Excel Template

Post a Comment for "Adjusted Gross Income Tax Rate Calculator"