Ctc To In-hand Salary Calculator

Basic Salary Include Dearness Allowance if any 2. These include deductions for provident fund medical insurance etc.

Salary Net Salary Gross Salary Cost To Company What Is The Difference

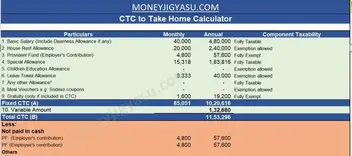

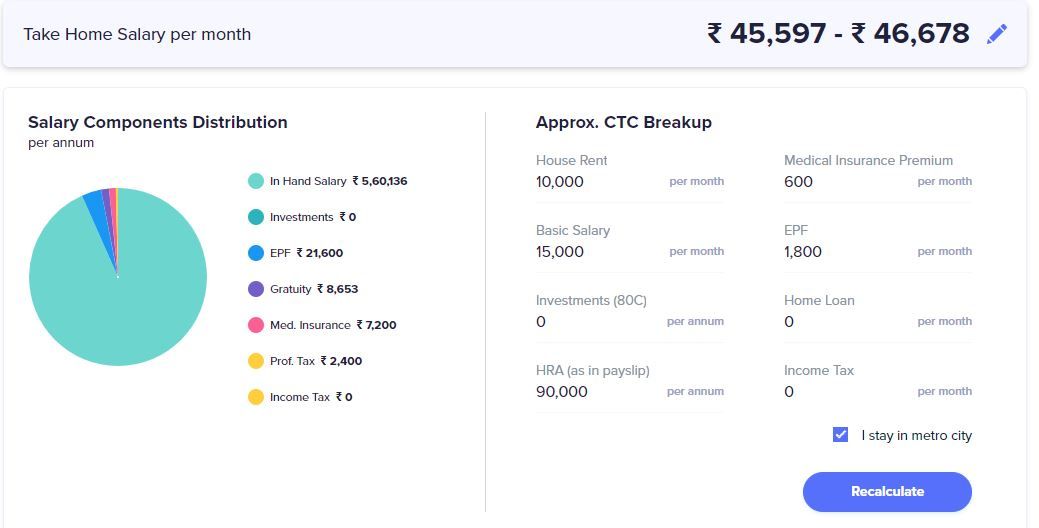

Scope of Take Home Salary Calculator India Excel In-Hand Salary Calculator India This calculator works if you have the following elements in your CTC.

Ctc to in-hand salary calculator. In-hand Salary Basic Salary Actual HRA Special Allowances Income Tax EPF Employees Provident Fund How To Calculate Gross Salary From CTC. Calculate taxable income by deducting necessary deductions from total income. The employer gives you a bonus of Rs50000 for the financial year.

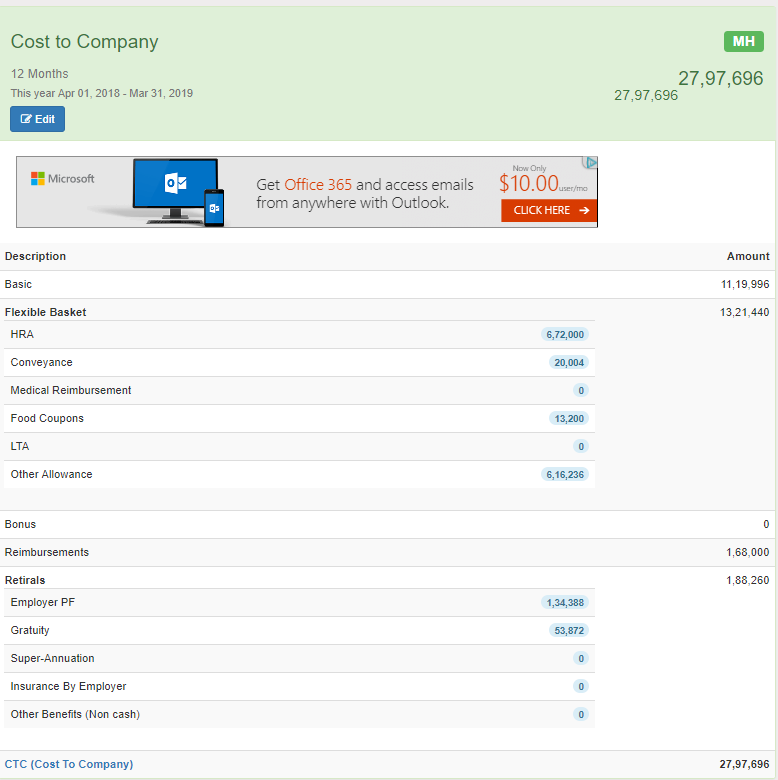

CTC Direct benefits monetary Indirect benefits non-monetary Savings contribution contribution to PF. The ClearTax Salary Calculator shows you the take-home salary in seconds. Minimum wages list should be update.

2 Your Cash in Hand per month is calculated after considering tax deducted at source from your Salary Income. Take home pay is also referred as Net salary. PayHR Online CTC salary calculator helps HR and Payroll Accountants to calculate how much Net Salary to be paid to employees based on agreed CTC.

Use In Hand salary calculator to find your Take Home Salary from the total CTC. In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any The deductions could vary from each company and are based on your CTC. Provident Fund Employers Contribution 4.

CTC generally includes basic salary house rent allowance HRA medical allowance transport allowance and other such allowancesvariable pay available to the employee. You can restructure allowances and CTC components as per your need. Let us assume the basic pay is 300000 12 of basic pay is considered for Employee PF.

Calculation Of In Hand Salary From CTC. In hand Salary CTC Sum of above components Lets see the calculation of above components as below PF Contributions 12 of Basic salary Employers Contribution 12 of basic salary Employees Contribution 12 45 lakh 12 45 lakh INR 108 Lakh. CTC AB 14250215716407 Monthly In hand salary- Gross salary-monthly deductions - 14250-780Employees PF- 250 Employees ESI-13220 Depending on company policy if company pays bonus on monthly basis please add the same in monthly gross salary re-calculation the same.

Calculate income tax by adding respective slab rate on taxable income. You can calculate Cost to company CTC Automatic once you put total ctc. It refers to the salary that an employee takes home once after the deduction of employment taxes cost of benefits and other retirement contributions.

Assuming your annual Fixed package is 725000 the below calculations are made. How to Calculate In-hand salary from CTC. The Hush Take home salary calculator estimates the in hand salary for the financial year 2020-21 which is the current financial year.

Income Tax to be calculate automatic. Thus In hand salary can be calculated easily from cost to company. This sheet will calculate House rent allowance HRA Rent Exemption calculation under section 1013A automatic as per.

Change Allowance name Bonus as applicable. You can set your investment Declaration or Proofs Planing as per requirement. Cost to Company CTC is an annual employee cost incurredto be incurred by the Company.

This is as per financial year 2019 - 2020. CTC Direct Benefits Indirect Benefits Savings Contributions. How to calculate the take home salary.

Your Excel Macros should be Enable. The ClearTax Salary Calculator will show you the performance bonus and the total gross pay. It is designed to show clear breakup of all the payroll components like Take Home Pay Gross Salary and Income Tax.

Click on Calculate button in case you are calculating CTC in bulk. They form a part of the compensation structure but doesnt get them as a part of an in-hand salary. How to use the ClearTax Salary Calculator.

Calculate Gross Salary by deducting EPF and Gratuity from the CTC. To calculate the take-home salary you must enter the Cost To Company CTC and the bonus if any as a fixed amount or a percentage of the CTC. Income tax is calculated by adding the respective slab rate on calculated taxable income.

3 Your Cash in Hand per month does not consider the amount spent on tax saving investmentinterest on home loan and profession tax deducted from your Salary. Uses of Take home salary calculator. Enter annual CTC amounts and then select the compliance settings as per your establishment applicability 2.

But it definitely increases the CTC. We start with calculating the Gross salary as follows. Then calculate in hand salary.

Type Annual CTC Amount. CTC Salary Breakup will be calculate Automatic. Finally calculate the in-hand salary.

Calculate the taxable income by making the required deductions from the total income. For example your Cost To Company CTC is Rs10 lakh. Enter the bonus included in the CTC as a percentage or amount.

Employee Skill and State name required. 36000 The same 12 will be deducted for. CTC is never equal to the amount of take-home salary.

To use the ClearTax Salary Calculator. Calculate gross salary by deducting EPF and gratuity from CTC. Gross Salary is the sum of all the earnings profits interest payments reimbursements and other forms of.

Gross salary CTC - PF - Gratuity. House Rent Allowance 3. Thanks regards Roopa Mehra Asst.

All you need is to enter the year CTC and monthly basic pay and the calculator will default all the parameters like EPF Gratuity Standard deduction HRA and Professional Tax before it calculates in hand salary. You must enter the yearly cost to the company or the CTC.

Change Ctc To Increase In Hand Salary India

Salary Calculator In Hand Salary Calculator Great Learning

Salary Formula Calculate Salary Calculator Excel Template

Ctc Salary Calculator Excel 2021 22 With Complete Payroll Setup Payroll Pedia

Ctc Salary Breakup Calculation Excel Sheet Automatic Calculation Cost To Company Youtube

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

What Are Some Good Salary Calculators Quora

Salary Calculator India Monthly Take Home Pay Cost To Company Income Tax Truvisa Immigration Visa Questions Reliable Answers

What Would Be My Take Home Monthly Salary At 13 Lpa Gross C2c Quora

Quick Answer Take Home Salary Calculator India Kerala Travel Tours

How To Use Ambitionbox Salary Calculator For Better Salary Negotiation

Salary Breakup Calculator Excel 2021 Salary Structure Calculator

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

What Would Be My In Hand Salary Every Month If The Offer Is 18 Lpa Ctc Quora

Salary Formula Calculate Salary Calculator Excel Template

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

What Is The Take Home Salary For A Ctc Of 14 Lpa Quora

How Much In Hand Salary Will I Get With A Package Of 7 Lpa Quora

Post a Comment for "Ctc To In-hand Salary Calculator"