Gross Income Calculator Arizona

One of a suite of free online calculators provided by the team at iCalculator. The formula underlying this alimony calculator for Arizona is this.

Gross Pay And Net Pay What S The Difference Paycheckcity

Income Tax Filing Requirements For tax years ending on or before December 31 2019 Individuals with an adjusted gross income of at least 5500 must file taxes and an Arizona resident is subject to tax on all income including from other states.

Gross income calculator arizona. Before you can calculate Arizona maintenance however you must enter gross income age and marriage length information into the calculator. Filing as a single person in Arizona you will get taxed at a rate of 259 on your first 26500 of taxable income. Jenkins case held that an increase in the value of property owned by a parent would not normally be included in the gross income of that parent to calculate child support.

Annual net income calculator. I have been unable to figure out the right way to calculate this. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month.

To do this you would take 45000 35000 80000 to come up with a final total income of 80000 In this case youll be using three tax brackets to determine your Arizona income tax. For Arizona filing purposes figure your gross income the same as you would figure your gross income for federal income tax filing purposes. Note that these are marginal tax rates so the rate in question only applies to the income that falls within that bracket.

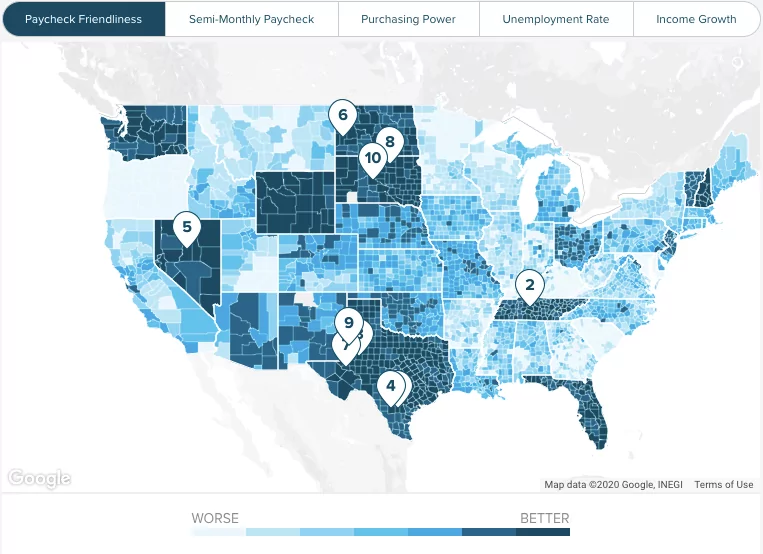

Net income is the money after taxation. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. Arizona State Tax Calculator.

If you earn 7000000 or earn close to it and live in Arizona then this will give you a rough idea of how much you will be paying in taxes on an annual basis. 334 up to 53000. Take the difference between the two spouses annual income and multiply it by the marital duration factor or the years of a marriage.

After a few seconds you will be provided with a full breakdown of the tax you are paying. If you are paid hourly multiply your hourly. Some money from your salary goes to a pension savings account insurance and other taxes.

This breakdown will include how much income tax you are paying state taxes federal. For the most part however calculating taxable income is a matter of subtracting deductions and exemptions from gross income. Using our Arizona Salary Tax Calculator.

You must combine both figures when determining how much Arizona income tax you will both have to pay. For example interest income from non-Arizona municipal bonds is taxable and must be added to taxable income. This tax calculator performs as a standalone State Tax calculator for Arizona it does not take into account federal taxes medicare decustions et al.

If you have questions about how income is. For the calculation we will be basing all of our steps on the idea that the individual filing their taxes has a salary of 7000000. Simply type in the Gross Annual Income and the Net Annual Income of the Payor of the alimony money and of the Recipient of the alimony money and your alimony payment will be estimated.

The Withholding Calculator helps you determine whether you need to give your employer a new Form A-4 Arizona Withholding Percentage Election. It determines the amount of gross wages before taxes and deductions that. There are two ways to determine your yearly net income.

Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. You can use your results from the calculator to help you complete the form and adjust your income tax withholding. The Arizona tax calculator is designed to provide a simple illlustration of the state income tax due.

Heres how you would calculate that figure. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. The Arizona Salary Calculator allows you to quickly calculate your salary after tax including Arizona State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Arizona state tax tables.

Calculate the gross amount of pay based on hours worked and rate of pay including overtime. Set the net hourly rate in the net salary section. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field.

417 up to 159000. The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more.

Does it just refer to Arizona gross income ie before adjustments. Enter the Gross Incomes. Itemized deductions in Arizona track very closely to federal itemized deductions.

To use our Arizona Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Arizona Maintenance Alimony Calculator makes Arizona maintenance calculations with one click of the mouse. First you must enter the spouses gross incomes.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. Although interest income from investments may also be included in income the Arizona Court of Appeals in the Jenkins v. The Arizona tax calculator is updated for the 202122 tax year.

Use this Arizona gross pay calculator to gross up wages based on net pay. And 450 on income beyond 159000. Does this mean federal gross income 15K - ie Form 1040 line 22.

Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. Summary report for total hours and total pay.

Taxable Income Formula Examples How To Calculate Taxable Income

How Does Your Income Stack Up To U S Government Salaries Government Income Paying Jobs

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Arizona Paycheck Calculator Smartasset

Pin On Free Mortgage Payment Calculator

Paycheck Calculator Take Home Pay Calculator

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

New Tax Law Take Home Pay Calculator For 75 000 Salary

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

6 Tax Tips For The Divorced Receipt Organization Tax Deductions Accounting Services

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Arizona Paycheck Calculator Smartasset

Excel Formula Income Tax Bracket Calculation Exceljet

Gross Pay And Net Pay What S The Difference Paycheckcity

Example Calculation For Az With Ncp Earning A Gross Monthly Income Of Download Table

Post a Comment for "Gross Income Calculator Arizona"