Take Home Salary After Tax Calculator India

Use the simple monthly tax calculator or switch to the advanced monthly tax calculator to review NIS payments and income tax deductions for 2021. Salary Before Tax your total earnings before any taxes have been deducted.

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

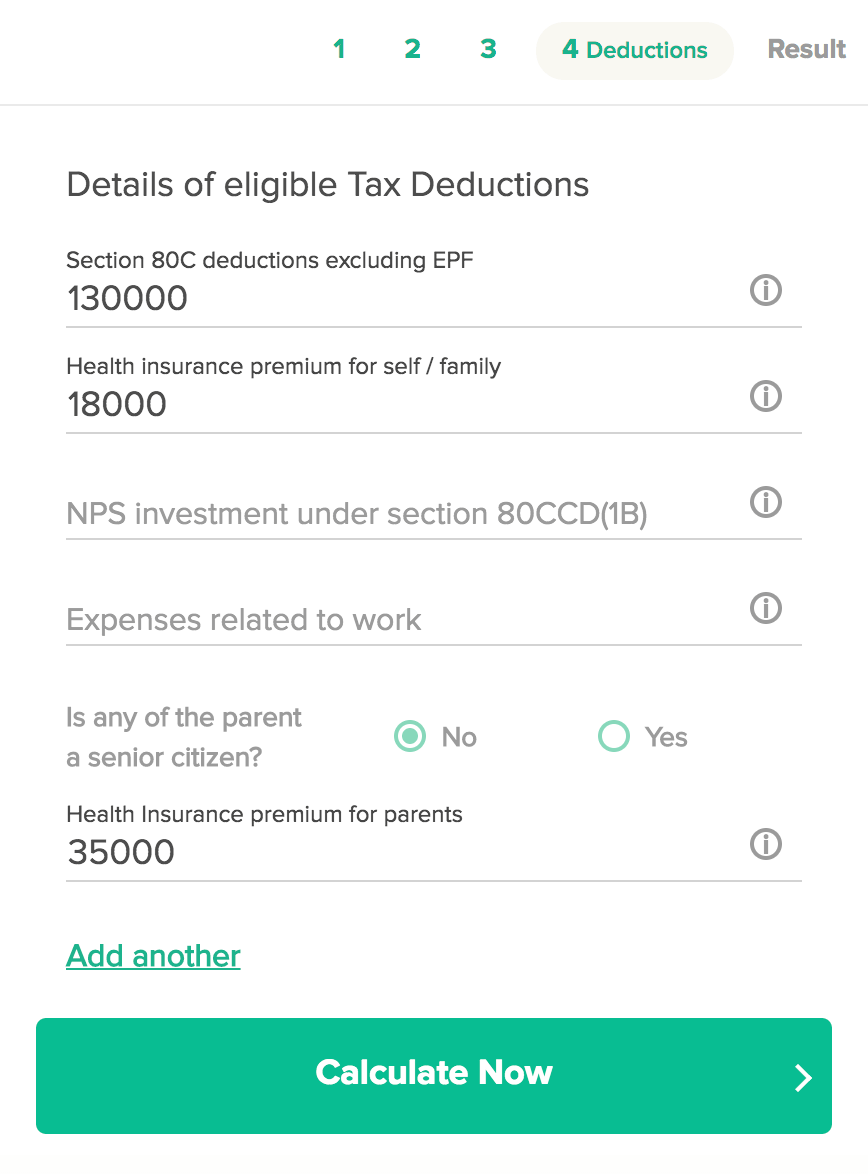

Not consider the amount spent on tax saving investmentinterest on home loan and profession tax deducted from your Salary.

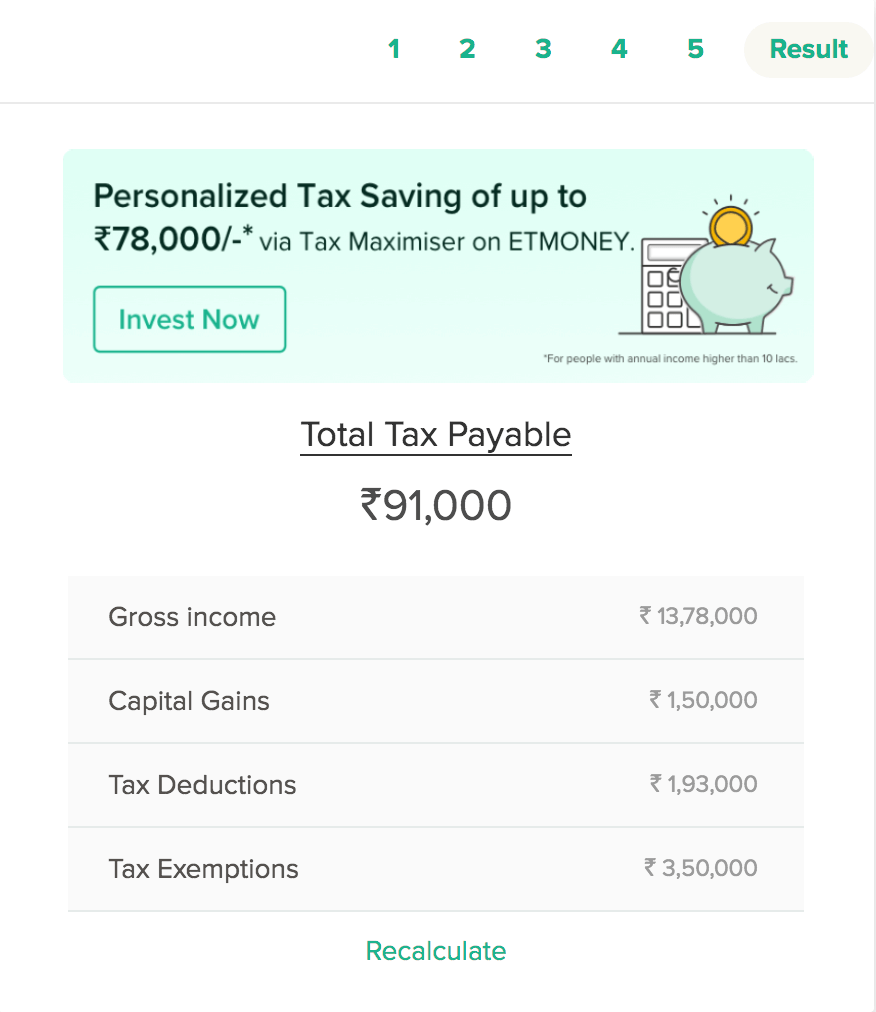

Take home salary after tax calculator india. You can calculate your Monthly take home pay based of your Monthly gross income Education Tax NIS and income tax for 202122. Youll then get a breakdown of your total tax liability and take-home pay. Youll then get a breakdown of your total tax liability and take-home pay.

How to use the Take-Home Calculator. Take home salary Gross Salary - Income Tax - PF - Professional tax Note. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Take-Home Salary Gross Pay Total Deductions. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

Also we have not included variable pay and income from other sources. The Indian Monthly Tax Calculator is updated for the 202122 assessment year. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

Your gross salary - Its the salary you have before tax. Find out the benefit of that overtime. ICalculator also provides historical Indian earning figures so individual employees and employers can review how much tax has been paid in previous assessment years or you can use the salary calculator 202122 to see home much your take.

All you need is to enter the year CTC and monthly basic pay and the calculator will default all the parameters like EPF Gratuity Standard deduction HRA and Professional Tax before it calculates in hand salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The calculator can help you find your monthly net salary if you know your salary package.

Take-Home Salary Rs 750000 Rs 48600 Rs 701400. Take-home pay known as in-hand salary in India is the net salary after deducting income tax TDS tax deducted at source in India and other deductions from the gross monthly pay. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. About the Monthly Tax Calculator. Where you live - The municipal tax differs between the municipalities.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Salary in India is normally paid on 1st day of month. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

This calculator is intended for use by US. Calculate PF contribution paid by employer ie 12 of the basic wage. Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred in india as in hand salary calculater.

In order to calculate the salary after tax we need to know a few things. Total deductions are Rs 2400Rs 21600Rs 21600 which equals Rs. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same.

2 Your Cash in Hand. Use this calculator to find your take home salary usually called in-hand salary in India after deducting income taxes before making a decision to join the new job. Take Home Salary Calculation from CTC Step by Step Process.

Salary calculations include gross annual income tax deductible elements such as NIS NHT education tax and include age related tax allowances. Income tax calculator. The amount of income tax withheld is known as TDS Tax deducted at source in India.

Social Security and Medicare. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Italy affect your income. Find out your take-home pay - MSE.

Now the gross salary of the employee is CTC PF gratuity paid by. Also known as Gross Income. 45600 Take home salary is equal to gross pay minus total deductions Take home salary is equal to Rs 500000 Rs 45600 Rs 424400.

So the take home salary calculator shows you the take home salary. Your tax liability is calculated after considering Tax Saving Investments and Interest on Home Loan. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

People who want to move to India should understand the CTC and evaluate their salary. Calculate the basic wage from the CTC 40-50 of CTC Gross Salary Calculation. It can also be used to help fill steps 3 and 4 of a W-4 form.

Gratuity paid by the employer is basic wage2615 Step 4. Calculate your take-home pay given income tax rates national insurance tax-free. Professional tax varies from state to state but we approximate it to Rs200month.

CTC Take Home Calculator.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Pin On Income Tax Filing Software Expert Services

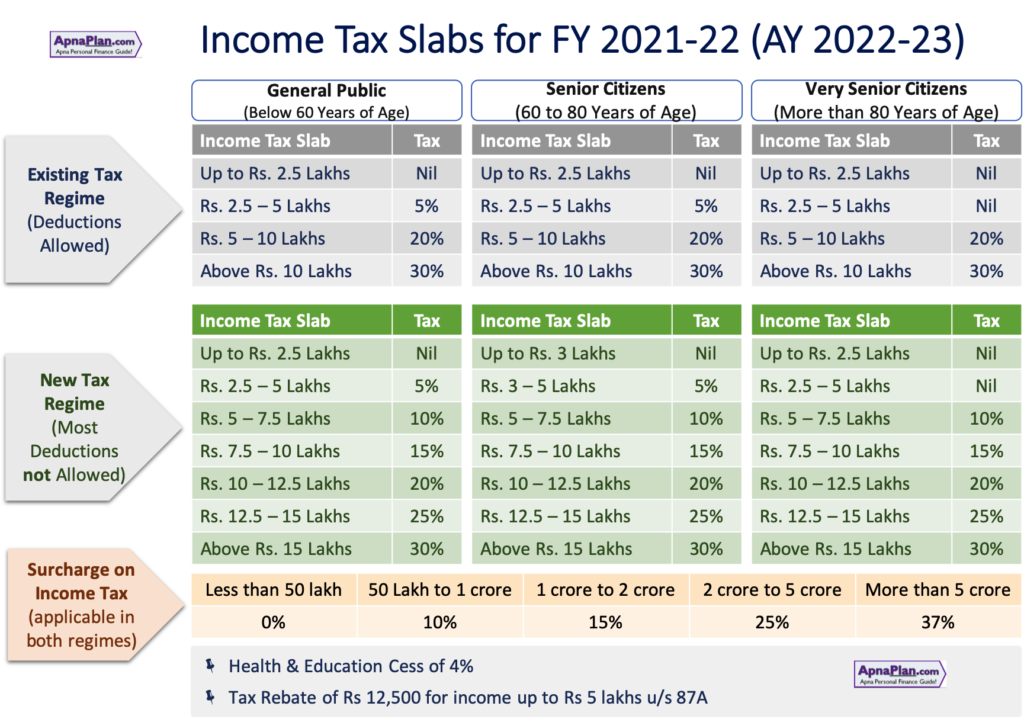

New Tax Regime Tax Slabs Income Tax Tax Income

Take Home Salary Calculator India Salary Calculator Salary Calculator

How You Can E Verify Itr V Or E Verify Income Tax Return Income Tax Return Income Tax Tax Refund

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Find Out The Income Tax Basics For Salaried Individuals On Income From Salary How To Save Income Tax Retireme Income Tax Goods And Services Income Tax Return

Income From House Property House Property Home Loans Tax Deductions

Want More Take Home Salary Then Ensure Correct Tds Deduction By Submitting Form No 12bb To Your Employ Best Investment Apps Income Tax Return Investing

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Business Tax Small Business Tax Deductions

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

What Is Ctc Difference Between Ctc And Take Home Salary Tax2win Salary Income Tax Deduction

There Are Certain Incomes Which Are Left Out Erroneously And You Become Liable To Pay Tax Later Consult Experts To File Your Taxes Tax Paying Taxes Income Tax

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Reduce Income Tax In India Income Tax Income Tax

Budget 2018 Income Tax Slabs For Fy 2018 19 Income Tax Income Income Tax Statement

Hmrc Tax Refund Revenue Online Services

Post a Comment for "Take Home Salary After Tax Calculator India"