Take Home Salary Pro Rata

The simplest way to work out how much youd be paid on a pro rata basis is dividing the annual salary by the number of full time hours and then times this number by the pro rata hours. This scheme offers support to employers who bring their staff back to work gradually.

Calculate Pro Rata Everything You Need To Know Tide Business

Just type your salary in the Annual Gross.

Take home salary pro rata. Take-Home Hourly Pay Desired Salary Pro-Rata How They Work. The government contribution is capped at 154175 per month. Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions.

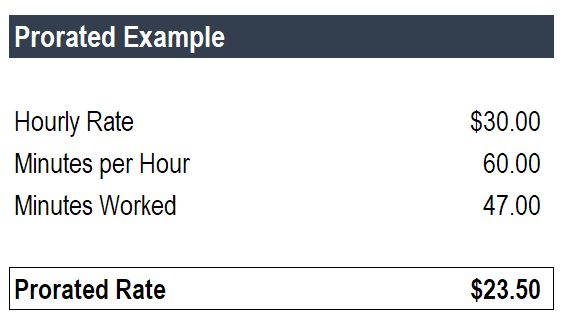

For example if the full-time salary is 20000 per year for 375 hours work per week the pro-rata salary based on a 18-hour working week would be. You can work out your take-home pay using our free prorated salary calculator which will also work out the Income Tax and National Insurance due. Includes Tax on Government Bonus.

As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well. 20000 x 18 375 9600. Use our Take Home salary calculator to work out what your salary should be after tax.

The basic calculation you can use to work out pro rata is as follows. Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. The figures are based on the 201718 tax year which started on.

In addition to income tax there are additional levies such as Medicare. You can also enter a percentage of your full salary if. If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how your take-home pay will be affected.

The information presented here is based on the fiscal regulations in Ireland in 2021. The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in.

1 The Statutory Bonus of 13510 is paid every six months and equates to 074 per calendar day including Saturdays and Sundays on a pro-rata basis. To help illustrate this and figure out exactly how much you get to take home from your pro-rata salary we have produced this simple pro-rata tax calculator to do all the annoying number crunching for you. The council site states teacher working days would be 195 day per year which works out at 39 weeks guess it is same for support staff.

R 428307 as per PAYE tables provided by SARS Take home pay Gross salary - PAYE - UIF UIF Unemployment Insurance Fund is levied at 1 of your taxable income at most R14872month Take home pay R 18000 - R 428307 - R 6864. Use our pro-rata salary calculator to work out what your actual pay will be if you do a part-time job. PRSI is only applicable to salaries higher than 5000 EUR per year.

Visit revenueie for more details. Annual salary full-time hours x actual work hours. Pro-Rata Furlough Tax Calculator.

Recently Ive had a couple of requests from users of the site to have a pro-rata calculator on the site so you can work out what your new pay would be if you go down to reduced hours or enter a job share of some sort. How to use the Pro-Rata Salary Calculator To use the pro-rata salary calculator enter the full-time annual salary in the Full-time Salary box. How to work out pro rata salary.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Tax you will pay PAYE Pay As You Earn for your age group and income bracket. The latest tax information from January 2021 has been applied.

Simply change the. 37 hours per week term time only. The better way to calculate pro rata pay entitlement is to work it out by hours rather than days.

The meaning of pro rata or the definition of pro rata according to Cambridge Dictionary is essentially to be paid in proportion of a fixed rate for a larger amount. Part-time jobs are often advertised with full-time salaries. So for the example above this would look as follows.

The Salary Calculator helps you to see what your take-home pay will be once you have paid income tax Universal Social Charge USC and Pay-Related Social Insurance PRSI. So I take it I would start on the low rate. For example you may be paid an annual salary of 25000 pro rata - but you only actually work for part time in which case youll be paid a proportion of the 25000 based on how much of the expected time youre actually working.

You can also see the impact of your pension contributions. 30000 annual salary 40 full time hours 750 750 x 25 pro rata hours 18750. This isnt always 100 accurate.

Enter the number of weekly hours that are considered full-time into the Full-time weekly hours box and the new pro-rata number of weekly hours into the Pro-rata weekly hours box. It includes things like pensions auto-enrolment student loans as well as the usual income tax and national insurance. Payments are made at the end of June and December and will be included in your payslips.

For reduced hours most employers will multiply the full-time salary by the reduced number of hours divided by the full-time hours. 705 x 37 hours per week 26085 x 39 weeks 1017315 per year. Field then press enter.

If you need an Income Tax Calculator youve come to the right place. For example if your annual salary pro rata is 30000 in a 40-hour week but you actually only worked 25 hours a week your part time salary would be 18750.

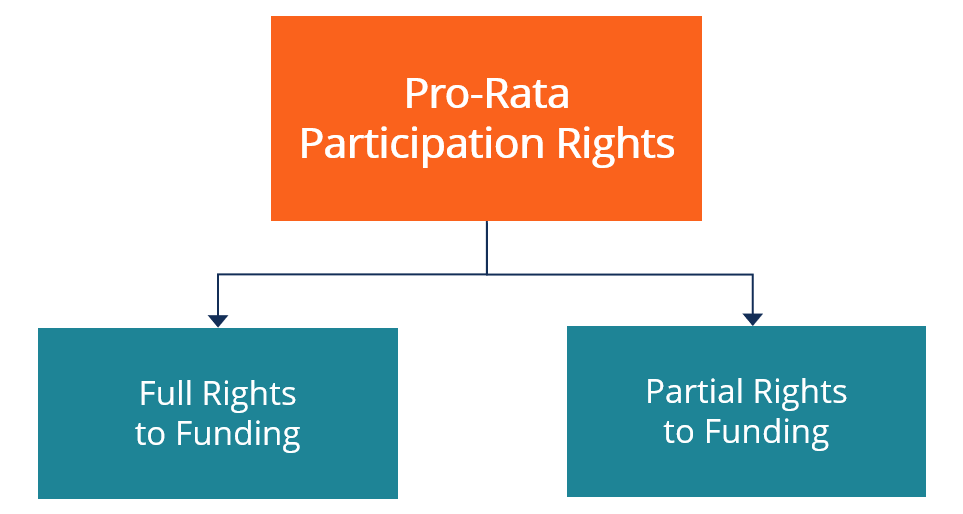

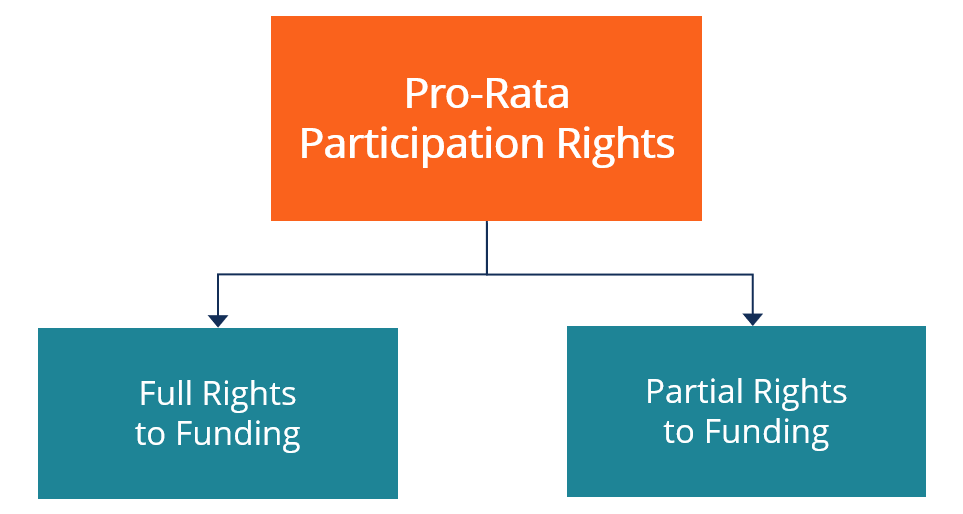

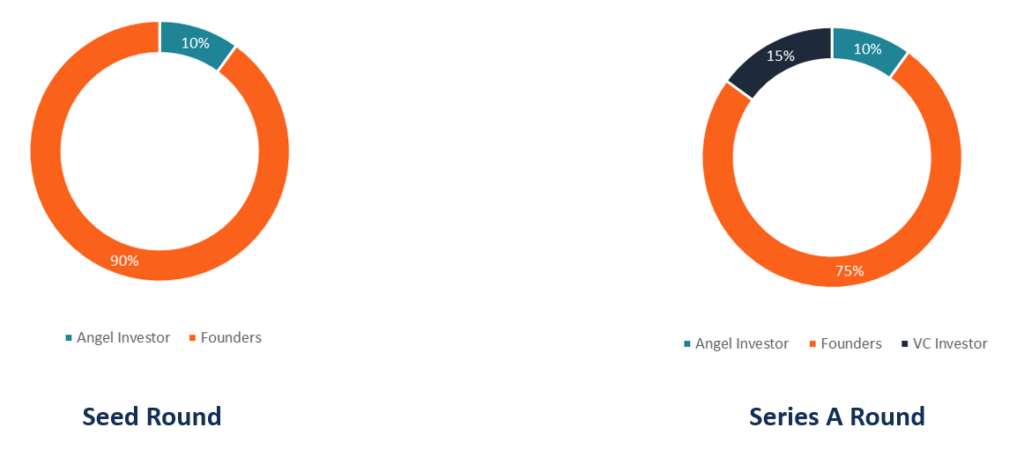

Pro Rata Participation Rights Overview How They Work Example

Pro Rata Commercial Real Estate Terms Explained Gmaven Dictionary

Web 3 0 Natural Language Processing Flexible Working Salary Calculator

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

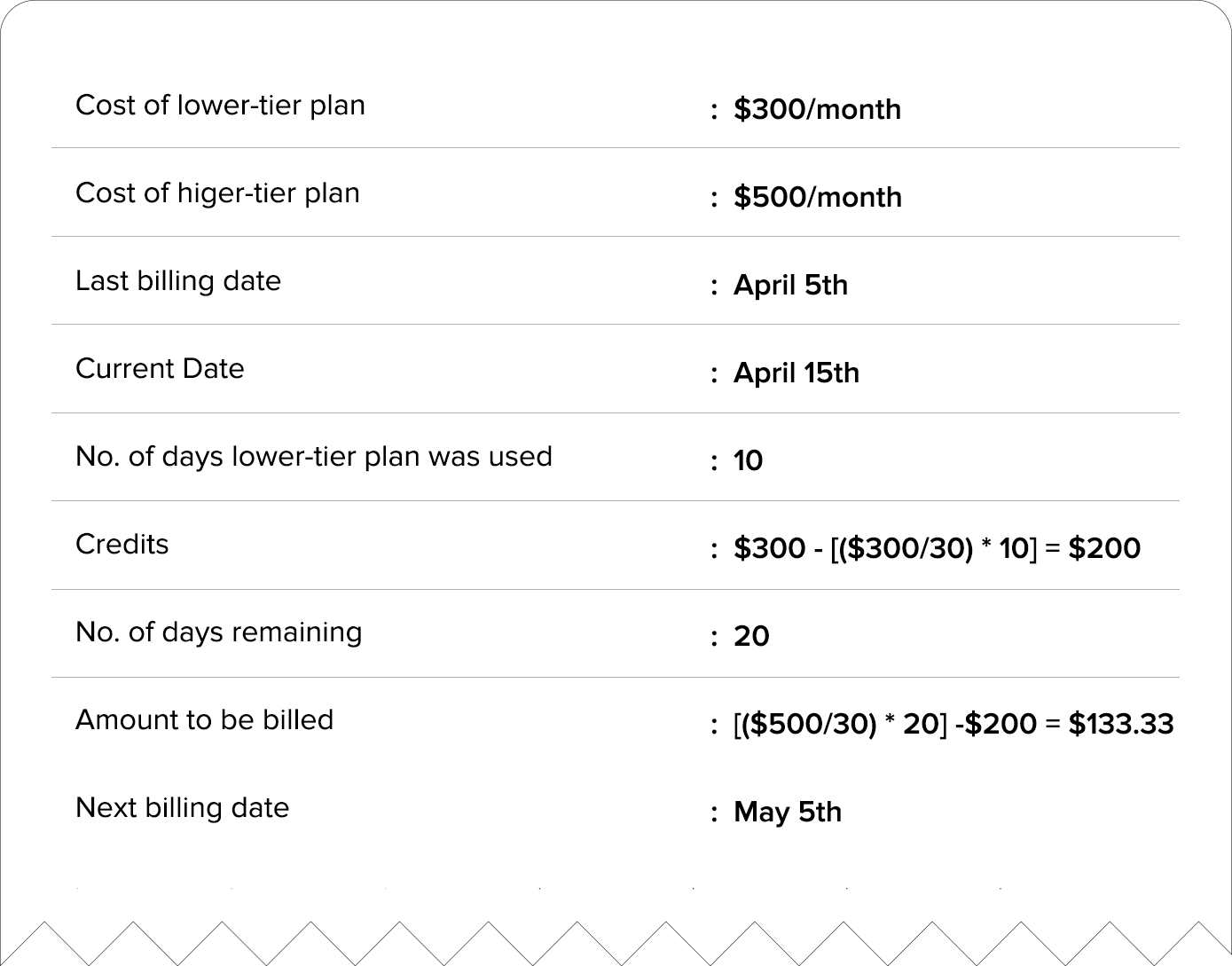

How Prorated Billing Works In Saas Businesses Zoho Subscriptions

Pro Rata Definition Uses And Practical Example

Calculate Pro Rata Everything You Need To Know Tide Business

Calculate Pro Rata Everything You Need To Know Tide Business

Calculate Pro Rata Everything You Need To Know Tide Business

Https Www Solihullcommunityhousing Org Uk Images Stories Fleximedia Askmat Calculating A Prorata Offer Pdf

Pro Rata Right Definition How Do Pro Rata Rights Work

Pro Rata Over Subscription And Calls In Arrears

How Do You Calculate Pro Rata Holiday Entitlement Citrushr

Prorated Learn When To Use And How To Prorate A Number

Pro Rata Salary Calculator Uk Tax Calculators

Confused About Pro Rata Charges Here S Everything You Need To Know Arrow Voice Data

Post a Comment for "Take Home Salary Pro Rata"