In Hand Salary Calculator Japan

The impact of taxation and any tax reliefs depends on individual circumstances. - Whether youre a fresher just starting your professional career or someone who has been working for several years Im sure the thought of how to.

Freshbooks Accounting Made Easy With Freshbooks Freshbooks Small Business Accounting Accounting Software

If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary.

In hand salary calculator japan. The greater of Annual Salary 40 or 650000. Since this process takes time if a bonus is planned to be paid in December we recommend fixing the amount of bonus to be paid at beginning of December and in any case. It refers to the salary that an employee takes home once after the deduction of employment taxes cost of benefits and other retirement contributions.

1800001 - 3600000 Annual Salary 30 180000. The Robert Half Salary Calculator puts information on current salaries at your fingertips. Use In Hand salary calculator to find your Take Home Salary from the total CTC.

Where you live - The municipal tax differs between the municipalities. 5700000 yen net salary. A quick and efficient way to compare salaries in Japan review income tax deductions for income in Japan and estimate your tax returns for your Salary in Japan.

Your gross salary - Its the salary you have before tax. The majority of websites offering salary information utilize a salary calculator function to present this data. Use the salary calculator above to quickly find out how much tax you will need to pay on your income.

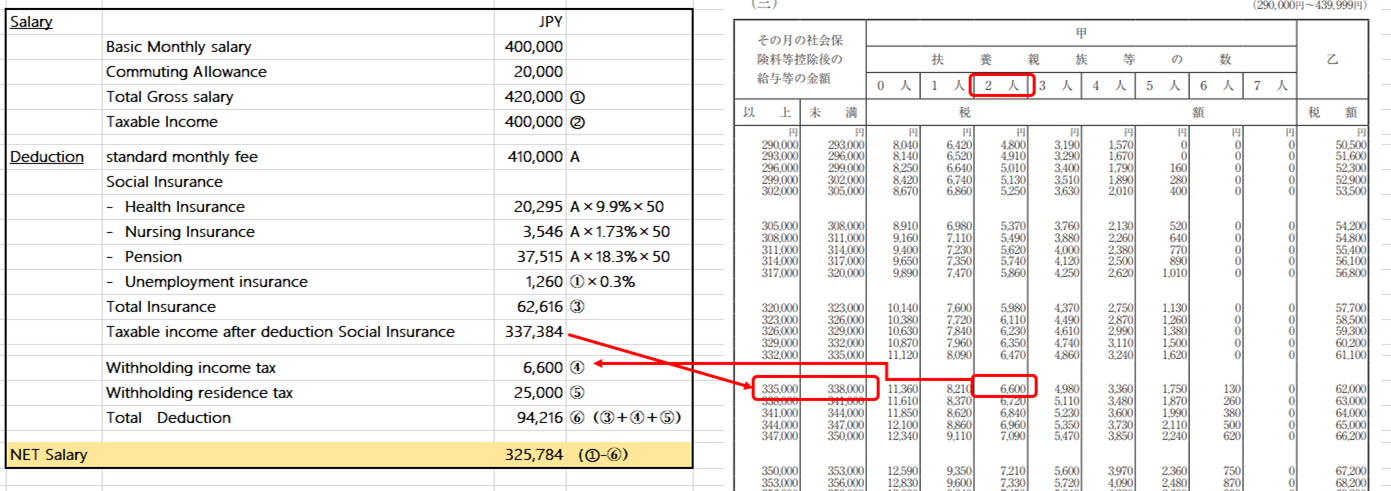

Monthly payroll calculations in Japan include monthly salary overtime commuting and other allowances social insurance contributions and taxes. Calculate your take home pay thats your salary after tax with the Japan Salary Calculator. Net Income Salary - Insurance - Income Tax - Residence Tax Income Tax Salary - Insurance - Residence Tax - Net Income.

Both the government and municipal taxes can be calculated by this Japan income tax calculator. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000. Results are based on.

How to calculate the net salary. Salary calculator A salary calculator is an online application that provides salary information to the user. The Japanese Tax Calculator is a diverse tool and we may refer to it as the wage calculator salary calculator or after tax calculator it.

Results do not represent actual withholdings as per Japanese tax law. The Payroll Calculator estimates net salary payment across 2 scenarios. 6600001 - 10000000 Annual Salary 10 1200000.

That said you get approx. 3600001 - 6600000 Annual income 20 540000. Tax amount will be determined based on the deducted salary 8m -1m in this estimate.

On the other end a senior level former hand 8 years of experience earns an average salary of 4251893. In Japan the company has to calculate the tax liability of the employee at year end and adjust the tax due on the last salary payment see article above Year End Adjustment. The salary calculator will request a search term city and state or zip code as an input.

This also assumes that you pay 1000000 yen yearly for mandatory health insurance and pension plan. The average monthly net salary in Japan JP is around 430000 YEN with a minimum income of around 130000 YEN per month. Job status age prefecture and work industry affects social insurance and dependents affect income taxes.

In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any The deductions could vary from each company and are based on your CTC. Take home pay is also referred as Net salary. An entry level former hand 1-3 years of experience earns an average salary of 2684458.

The taxpayers base salary is 100000 US dollars USD and the calculation covers 3 years. Important Notes the results from this calculator should be used as an indication only. An online tool that allows teachers.

CALCULATE YOUR SALARY. This calculation assumes a married taxpayer resident in Japan with two children whose 3- year assignment begins 1 January 2019 and ends 31 December 2021. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Japan.

Discover average salary ranges for finance accounting financial services and technology professionals in Japan with the Robert Half Salary Calculator. Salary Calculator Discover average salary ranges for finance accounting financial services and technology professionals in Japan with the Robert Half Salary Calculator. In order to calculate the salary after tax we need to know a few things.

This places Japan on the 2nd place in the Organisation for Economic Co-operation and Development after United States but before Germany. 10000001 - 15000000 Annual Salary 5 1700000. Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay.

It is advised that you consult with us for an accurate result. In this case your income tax including both national income tax and local one will be about 1300000 yen. The Japan tax calculator is a useful tool to find the taxes.

FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc.

Japanese Salary Systems Salary Guide And Calculation Method G Talent Blog

Men S Clothing Sizes In Japan Japanese Outfits Japan Outfit Shoes Too Big

What Can I Expect To Make In Japan Average Salaries In 2020 Tsunagu Local

What Is The Average Annual Salary Bonus In Japan Blog

What Is The Average Salary In Japan By Occupation And Age Blog

What Is The Average Salary In Japan By Occupation And Age Blog

Chris Rhee On Twitter Top Chef Izakaya Osaka

Japan Calculator Capitaltaxltd The Calculator Below Will

546 Ten Thousand Yen Note Illustrations Clip Art Istock

What Is The Average Salary In Japan By Occupation And Age Blog

On Financing Retirement Health And Long Term Care In Japan In Imf Working Papers Volume 2018 Issue 249 2018

Japan Salary Calculator 2021 22

You Vs Kardashians In 2021 Salary Calculator Kardashian Salary

Japanese Salary Systems Salary Guide And Calculation Method G Talent Blog

Japanese Salary Systems Salary Guide And Calculation Method G Talent Blog

Real Estate Related Taxes And Fees In Japan

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

How Much Is The Good Salary In Japan Quora

Payroll Services In Japan How To Calculate Monthly Payroll Withholding Income Tax Social Insurance Shimada Associates

Post a Comment for "In Hand Salary Calculator Japan"