In Hand Salary Calculator Monthly

Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Salary Calculator In Hand Salary Calculator Great Learning

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

In hand salary calculator monthly. Also known as Gross Income. Professional tax varies from state to state but we approximate it to Rs200month. The latest budget information from April 2021 is used to show you exactly what you need to know.

This includes the extension of the Low and Middle Income Tax Offset LMITO for the 2021-22 tax year. Use the simple monthly tax calculator or switch to the advanced monthly tax calculator to review NIS payments and income tax deductions. To calculate Weekly salary to hourly income.

You can calculate your Monthly take home pay based of your Monthly gross income Education Tax NIS and income tax for 202122. Adjustments are made for holiday and vacation days. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Hourly rates weekly pay and bonuses are also catered for. Salary Before Tax your total earnings before any taxes have been deducted. If you are using the Pay Calculator as a Salary Calculator simply enter your annual salary and select the relevant options to your income.

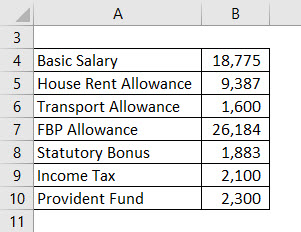

Youll then get a breakdown of your total tax liability and take-home pay. In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any The deductions could vary from each company and are based on your CTC Cost to Company package. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in the Netherlands.

Why not find your dream salary too. If you earn over 200000 youll also pay a. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. You can then see how your salary is broken down into weekly fortnight or monthly earnings.

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. If you have HELPHECS debt you can calculate debt repayments. Your average tax rate is 221 and your marginal tax rate is 349.

Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if. Also you can try an online free monthly salary calculator to calculate monthly salarywage and also helps you to figure out annual income according to different pay frequencies. This marginal tax rate means that your immediate additional income will be taxed at this rate.

About the Monthly Tax Calculator. The Indian Monthly Tax Calculator is updated for the 202122 assessment year. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

The salary calculator is a simulation that calculates your take-home salary. If you are earning 100 in one week 40 working hours in one week 25 in one hour. It is the total salary an employee gets after all the necessary deductions.

In most cases your salary will be provided by your employer on an annual basis. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Salary After Tax.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Enter Your Salary and the Netherlands Salary Calculator will automatically produce a salary after tax illustration for you simple.

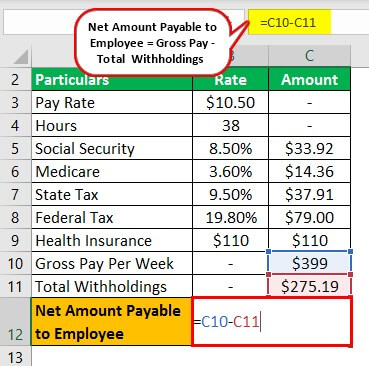

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Take home salary Gross Salary - Income Tax - PF - Professional tax Note. That means that your net pay will be 40512 per year or 3376 per month.

Youll then get a breakdown of your total tax liability and take-home pay. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. The salary calculator consists of a formula box where you enter the Cost To Company CTC and the bonus included in the CTC.

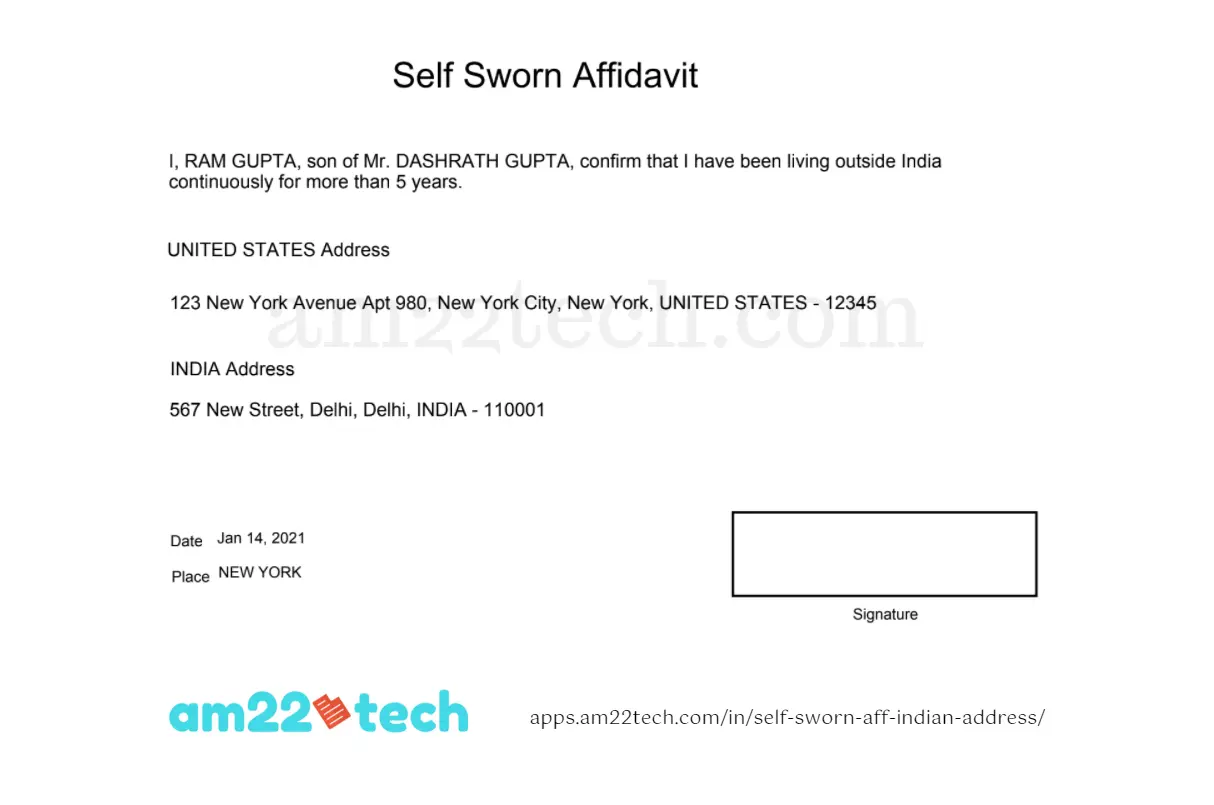

Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred in india as in hand salary calculater. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. All you need is to enter the year CTC and monthly basic pay and the calculator will default all the parameters like EPF Gratuity Standard deduction HRA and Professional Tax before it calculates in hand salary.

Finally using the above value we can compute the in hand salary as follows. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income.

What Is The Take Home Salary For A Ctc Of 14 Lpa Quora

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

How Much In Hand Salary Will I Get With A Package Of 7 Lpa Quora

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

Payroll Formula Step By Step Calculation With Examples

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

What Would Be My Take Home Monthly Salary At 13 Lpa Gross C2c Quora

Salary Net Salary Gross Salary Cost To Company What Is The Difference

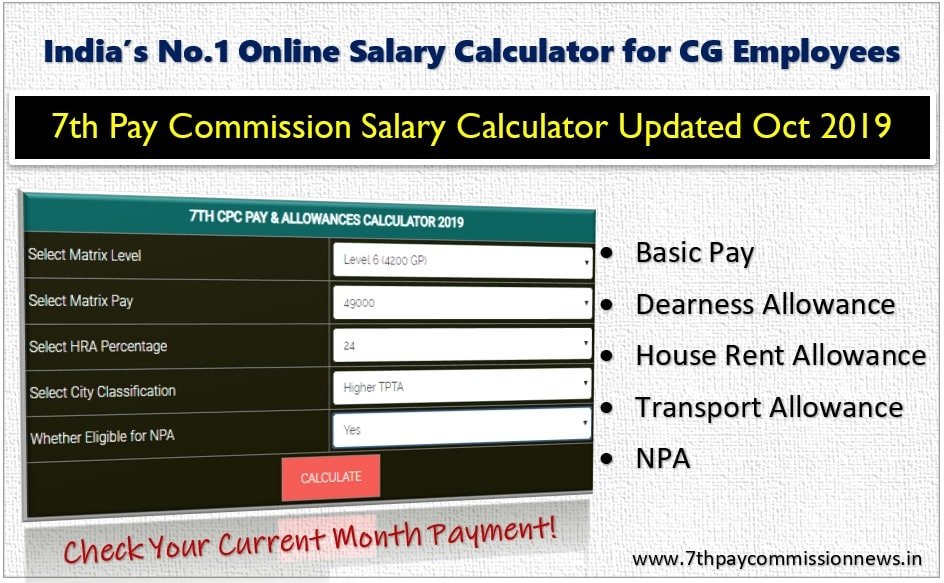

How To Calculate First Month Salary How To Calculate Salary Per Month In India Central Government Employees News

Salary Slip For 30000 Per Month In Excel Pdf With Breakup

4 Ways To Calculate Annual Salary Wikihow

7th Pay Commission Salary Calculator 2021 7th Cpc Pay Scale Calculator 2021 Central Government Employees News

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Post a Comment for "In Hand Salary Calculator Monthly"