Take Home Salary Uk 45000

Your total net yearly amount after tax and NI will be 34240 and your hourly rate will be 2163 if youre working 40 hours a week as a full time employee. Your hourly rate will be 2163 if youre working 40 hours per week.

Solve Frits Thaulow Cottages Along A River Normandy Jigsaw Puzzle Online With 72 Pieces

If you earn 5000 a year then after your taxes and national insurance you will take home 5000 a year or 417 per month as a net salary.

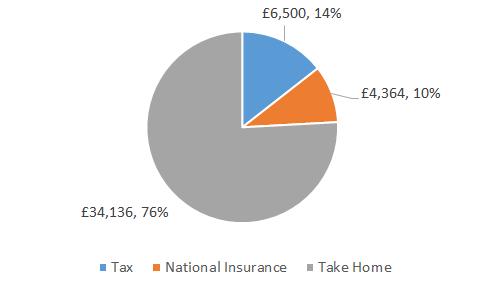

Take home salary uk 45000. If your income is 45000 then after tax you will be left with a net monthly take-home salary of 2853. The total tax you owe as an employee to HMRC is 10738 per our tax calculator. You will pay a total of 6500 in tax this year and youll also have to pay 4260 in National Insurance.

Your employer collects this through PAYE and pays it over to HMRC on your behalf. If your income is 45000 45k a year your after tax take home pay would be 3362808 per year.

If you work 5 days per week this is 140 per day or 17 per hour at 40 hours per week. Annual take-home pay breakdown 4100000 Net Income. Youll pay 144 of your income as tax This means the tax on your 45000 per year salary is 648600.

For the 202122 tax year 45000 after tax works out to be 3426216 take home salary or 3381849 if you live in Scotland. On a 45000 salary your take home pay will be 34262 after tax and National Insurance. 45000 a month after tax.

With our tax calculator find out what is your take home pay net wage from a gross salary of 45000 a month using Income Tax Calcuator 45000 A Month After Tax is 24780. If you work 5 days per week this is 132 per day or 16 per hour at 40 hours per week. Want more information on your 45000 salary.

The total cost of employment for an employee on a 4500000 Salary per year is 5102958 this is also known as the Salary Package. Annual take-home pay breakdown 4500000 Net Income. As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well.

If you earn an annual gross salary of 45k in the UK after income tax and national insurance deducted take home pay makes 2832 monthly net salary. Based on a 40 hours work-week your hourly rate will be 240 with your 5000 salary. Salary Take home pay.

109 of your income is taxed as national insurance 488592 per year. This is understandable given the increasing lifespan and the ever growing population in the UK. This equates to 2855 per month and 659 per week.

Lets take a look and see what kind of deductions youll have from your gross salary. Your personal allowance will be which means youll only pay tax on from your salary. This figure is for guidance only and does not in any way constitute financial advice.

45000 after tax and National Insurance will result in a 2853 monthly net salary in 2019 leaving you with 34240 take home pay in a year. For the 2019 2020 tax year 45000 after tax is 34136 annually and it makes 2845 net monthly salary. The government contribution is capped at 154175 per month.

So a basic salary of 4500000 is a 5102958 Salary Package on top of which can include company car costs healthcare costs and other employee related business costs. Guide to getting paid Our salary calculator indicates that on a 45000 salary gross income of 45000 per year you receive take home pay of 34262 a net wage of 34262. This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment.

Chart 4 illustrates how home of their gross income an individual earning 4500000 has historically received as take home pay the money you receive into your. 45000 After Tax in England. This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment.

This is 280234 per month 64669 per week or 12934 per day. This equates to 3025 per month and 698 per week. On a 48000 salary your take home pay will be 36302 after tax and National Insurance.

Google Seo Tools Do You Know Using These 3 Free Google Seo Tools Will Help You Grow Your Blog I Highly Suggest Installi Blog Growth Free Seo Tools Google Seo

Simplify Your Life With These Frugal Living Tips To Save More Money Frugal Living Tips Simple Frugal Living Ti In 2020 Frugal Living Tips Money Saving Tips Uk Frugal

Account Manager Project Manager London 35k To 45k V03874 In 2021 Elegant Kitchen Design Kitchen Background Design Jobs

Claim Income Tax Reliefs Gov Uk Income Tax Income Tax

Are You An It Professional And Want To Settle In Canada There Are Various High Paying Entry Level Positions Which Include Co Computer Support Job Roles Canada

Fixed Salary Earn Rs 13 500 To 45 000 On Monthly Basis In 2021 Part Time Jobs Travel Companies Home Based Jobs

What Next For House Prices In Britain From 2020 Onwards House Prices Homes England Property Prices

45 000 After Tax 2021 Income Tax Uk

10 Free Online Form Filling Jobs From Home To Earn 45k Without Investment Typing Jobs Night Jobs Typing Jobs From Home

Three Aircraft Art Uk Aircraft Art Art Art Uk

Melanie Sage Social Work Geek How Much Do Child Welfare Social Workers Make National Sample Of Child Wel Child Welfare Social Work Social Work Social Worker

Salary Rs 25 000 To 45 000 Per Month Part Time Jobs Job Online Data Entry

The Salary Calculator Pro Rata Tax Calculator

The Uk Is In Europe It Is Made Up Of Four Countries Northern Ireland Wales Scotland And Engl United Kingdom Travel Guide United Kingdom Travel Travel Guide

House Of Macalpin Family Tree In 2021 Family Tree Tree Family

Post a Comment for "Take Home Salary Uk 45000"